If the price crosses these thresholds, your orders execute automatically, helping you maximize your profits or minimize your losses. The only problem with stop-limit orders is that they force you to pick a direction.

Think Bitcoin’s going to go down? Then you have the option to set a stop-loss order at $46,000.

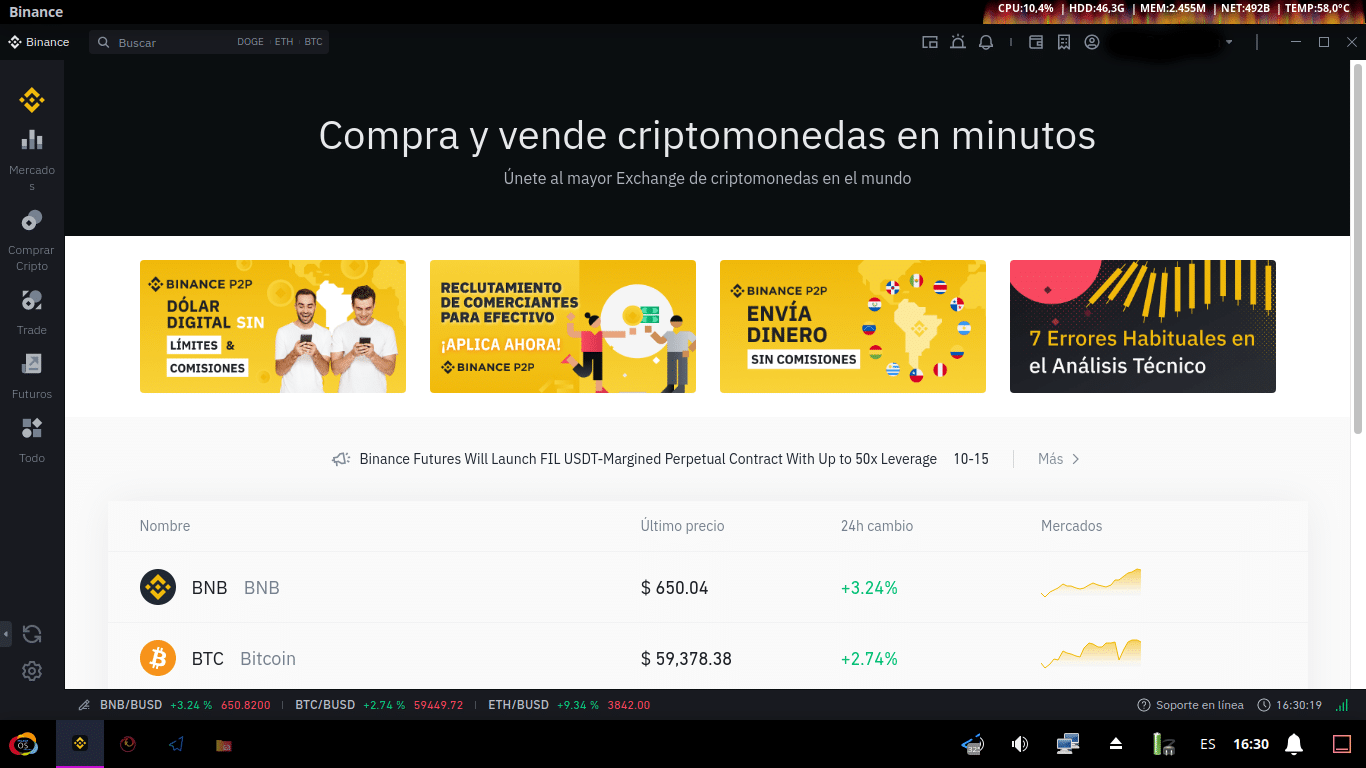

This is because there is a gap between selling and buying order prices, and you are, in effect, jumping the queue and trading at the best immediate offer) A market order allows you to buy or sell instantly at the current price (note that you’ll either buy a slightly higher price or sell at a slightly lower price.Binance offers a few different types of spot trading options, such as market, limit, stop-limit, and OCO. The easiest way to trade is by executing spot trades at real-time prices.

0 kommentar(er)

0 kommentar(er)